Academia Sinica/NBRP Venture Studio

About

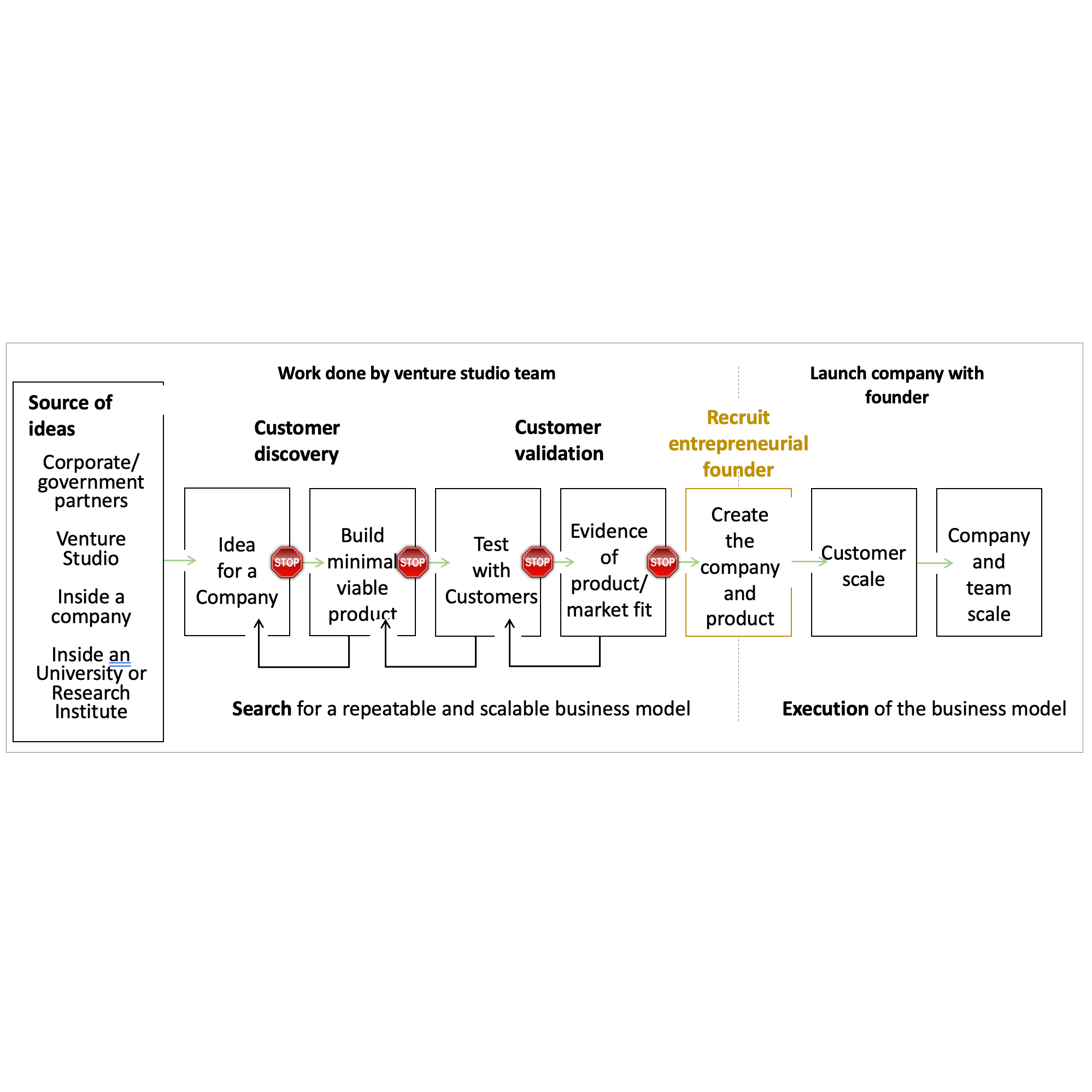

In partnership with Prof. Han-Chung Wu of Academia Sinica, we co-established Taiwan’s first venture studio dedicated to early-stage drug discovery within the National Biotechnology Research Park (NBRP). This initiative serves as a specialized incubation platform that systematically transforms academic research into investable biotech ventures.

The studio integrates Academia Sinica’s strengths in molecular and translational medicine with our expertise in biotech venture formation, building an end-to-end structure encompassing target validation, preclinical strategy, business modeling, and venture team assembly.

Several startup projects are currently underway, focusing on immuno-oncology, neurodegenerative disorders, and rare diseases, and are in early engagement with global pharmaceutical companies and institutional investors. This collaboration is positioned as a national model for science-to-market transformation, and forms a key component of Academia Sinica’s strategy to accelerate innovation commercialization and international partnerships.